What is Critical Illness Insurance?

Critical Illness Insurance at a Glance

Critical Illness Insurance provides a lump-sum benefit after the diagnosis of an insured condition, giving you the independence to make meaningful decisions about your physical and financial recovery and protect your standard of living. The benefit may be used in any manner you choose. For example, you could:

Supplement lost income due to time off work/spouse’s time off work

Private medical care (jump queue)

Flights and hotel rooms during treatments

Flights for family to visit

Nanny to help out with children

Or anything else!

Why Purchase Critical Illness Insurance?

“Life expectancy” is not equal to “health expectancy”. In fact, the average 45 yr old male, non–smoker has almost a 20%* chance of suffering from a critical illness before the age of 65. With advances in medical science improving, the chances of survival after the diagnosis of a serious illness are heightened.

*combined incidence rates for Cancer (“New cases for ICD-03 primary sites of cancer: 2002-2007”) and the Heart and Stroke Foundation of Canada (“The Growing Burden of Heart Disease and Stroke in Canada, 2003”).

Critical Illness Insurance is a perfect complement to income replacement coverage. It can be used to cover additional expenses that may be faced if you suffer from a severe injury, or catastrophic illness such as cancer, heart attack or stroke. Income replacement, on the other hand, is designed to protect everyday living expenses.

How do Critical Illness Insurance Policies work?

Benefit amounts of $25,000 to $2 million

Benefit is paid upon reaching survival period after diagnosis of a covered condition

Survival period is normally 30 days

The lump sum can be used however you choose

Early Intervention Benefit of 25% upon diagnosis (varies by insurance company)

Return of Premium on Death option

Coverage Types:

| Coverage Options | Premium Structure | Issue Ages |

| Renewable | 10-year – increases every 10 years to age 75

20-year – increases every 20 years to age 75 | 18-54 |

| Primary | Level premiums to age 65 | 18-45 |

| Level | Level premiums to age 100 | 18-60 |

| Permanent | Level premiums to age 100

Level premiums for 15 years*

*not available on all policies | 18-60 |

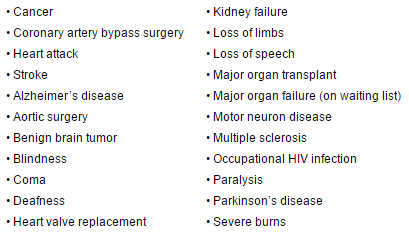

Covered Conditions*

*covered conditions & definitions vary by insurance company

Plan Features & Options*

Included: Early Intervention Benefit, Recovery Benefit, Surgical Benefit

Riders: Return of Premium on Death, Return of Premium on Expiry or Surrender, Second Event Rider, Waiver of Premium, Child Coverage

*features and options vary by company